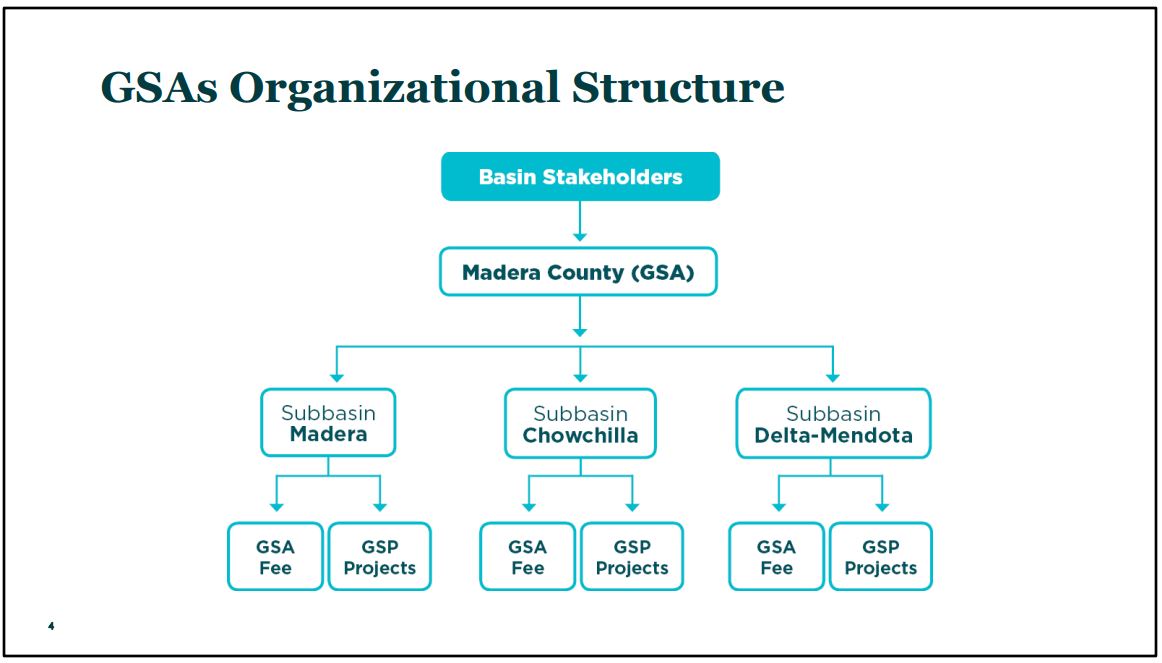

Under the Sustainable Groundwater Management Act (SGMA), the Groundwater Sustainability Agencies (GSAs) are charged with the duty of managing groundwater within the GSAs’ respective boundaries for the benefit of all extractors and users of groundwater. The County engaged a financial consultant to conduct two rate studies beginning in 2019 to help develop a fair and equitable fee structure that would enable cost recovery for the activities related to complying with SGMA and fees for projects and management actions for county-managed land.

GSA (Admin) Fee

The fee is designed to help the County GSA recover the administrative costs associated with GSA activities, such as outreach, grant administration, technical support services, legal and professional services, studies (e.g., recharge), annual and five-year reporting, and reserve funding (as allowed under SGMA per Water Code section 10730). The goal of the fee is to ensure that GSAs operations are self-sustaining, and only assessed to the areas of each subbasin managed by the County. This fee required adoption by the Board of Supervisors acting as the Board of Directors for the County GSAs.

GSP (Programs and Management Actions) Fee – Under a preliminary injunction

The second fee covers the programmatic costs for the County GSAs to implement groundwater sustainability plans (GSPs). Such a fee is provided for in Water Code section 10730.2, was set and approved under the rate-setting process set forth in Proposition 218, a state constitutional amendment which grants voters the power to approve local fees for service (for example water and sewer rates). The GSP-related costs include recharge, purchased water for recharge and agricultural use, water rights applications and permits, a dry well mitigation fund, land repurposing and other activities necessary for implementation of GSPs. The goal of this fee is to help achieve sustainable outcomes for the subbasins over the SGMA implementation period (through 2040).

Why are the Fees Needed?

SGMA was passed by the Legislature in 2014. SGMA requires groundwater subbasins to reach sustainability by 2040. In order to demonstrate how sustainability will be achieved, SGMA requires GSAs within a subbasin to develop a GSP. The GSP is the guiding document to implement solutions over a 20-year period to achieve sustainability. Besides the solutions outlined in the GSP, the GSAs require personnel, outside professionals, tools and data to administer the GSA activities.

The County-managed groundwater subbasin areas cover only a portion of the County’s total land area. The fee will ensure that only those in each County GSA pay for the benefit of sustainable management and unaffected areas are not assessed for a benefit that is not received.

Who is Affected?

The fees will be assessed to enrolled acres (typically irrigated acreage) within the County-managed areas of the Madera, Chowchilla, and Delta-Mendota subbasins beginning in 2020 for the GSA (Admin) Fee and fall 2022 for the GSP (Projects and Management Actions) fee.

How are the fees calculated?

This was developed with Board direction according to the timeline below to levy fees on irrigated acres within the County GSAs in the Madera, Chowchilla and Delta-Mendota Subbasin.

Fee Timeline

The timeline for implementation of fees is below.

- GSA (Admin Fee) appeared on property tax bills in fall 2020

- GSP Fee Hearing on June 21, 2022 at 10:30 in the Board of Supervisors Chambers for Madera County

- GSP Fee (absent majority protest) will appear on property tax bills in fall 2022

County GSA Alternatives

County GSA (Admin) Fee Documents

Madera County 2019 GSA Groundwater Sustainability Fee Study Draft Report 10/23/2019

Madera County 2020 GSA Groundwater Sustainability Fee Study Update – Final Report 7/13/2020

Ordinance number 689; GSA Ordinance 689 Summary

Resolution No. 2019-172

Resolution No. 2020-107

GSP Fee Resolutions

RES NO. 2022-086 Madera GSP Fee

RES NO. 2022-087 Delta-Mendota GSP Fee